food tax in maryland

Does anyone know what items arent taxed here. Sales of alcoholic beverages are taxed at 9.

Sales Tax On Grocery Items Taxjar

What transactions are generally subject to sales tax in Maryland.

. In Maryland this type of tax is called the Sales and Use tax and. Grocery Food EXEMPT Sales of grocery food are exempt from the sales tax in Maryland. For example if I go grocery shopping will there be a tax rate.

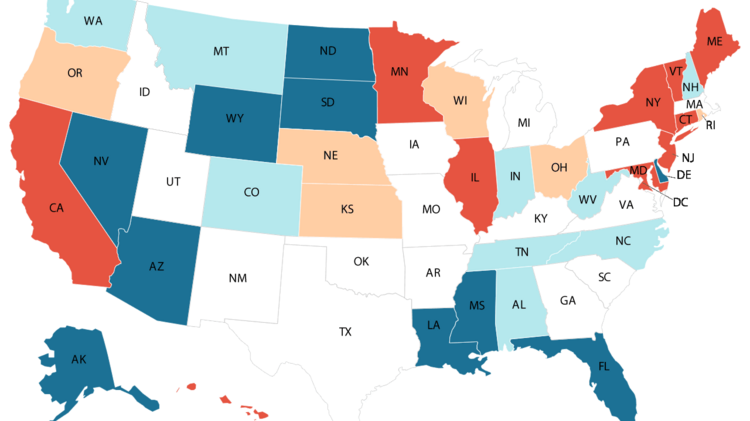

However if a grocery store that falls under this category sells prepared foods that can be consumed on the premises or carried out then you will most likely pay a 6 sales tax. We include these in their state sales. 53 rows Table 1.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maryland FoodBeverage Tax. Back to Maryland Sales Tax Handbook Top. A Maryland FoodBeverage Tax can only be obtained through an authorized government agency.

2022 Maryland state sales tax. Truck rentals are taxed at 8. 6 Average Sales Tax With Local.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. The taxable price of each piece of exempt equipment must be at least 2000. A Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Click here for a larger sales tax map or here for a sales tax table. Maryland Beer Tax - 009 gallon Marylands general sales tax of 6 does not apply to the purchase of beer. Everyone has the right to apply for SNAP.

Vendors should multiply their gross receipts by 9450 percent before applying the 6 percent rate to determine the tax due. To learn more see a full list of taxable and tax-exempt items in Maryland. Sale of candy or confectionery.

In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and the food is not a taxable prepared food. Counties and cities are not allowed to collect local sales taxes. B Three states levy mandatory statewide local add-on sales taxes.

Applicants must file an application be interviewed and meet all financial and technical eligibility factors. A 6 tax rate applies to most goods and services. Catering TAXABLE In the state of Maryland any voluntary gratuities that are distributed to employees are not considered to be taxable.

In addition tax applies to the sale of all other food in vending machines including prepared food such as sandwiches or ice cream. There are a total of 45 local tax jurisdictions across the state collecting an average local tax of NA. Is the food taxed here in Maryland.

Exempt Production Activity Items. In Maryland beer vendors are responsible for paying a state excise tax of 009 per gallon plus Federal excise taxes for all beer sold. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maryland Meals Tax Restaurant Tax.

Food and Beverages FAQs. This is why you wont have to pay a Maryland food tax on a box of crackers. Several examples of exceptions to this tax are foods considered to be snack foods most prescription medications in addition to most medical.

While sales of snack food milk fresh fruit fresh vegetables and yogurt through vending machines are not taxable the tax applies to the sale of all other food including prepared food such as sandwiches or ice cream. 6 Maryland has state sales tax of 6 and allows local governments to collect a local option sales tax of up to NA. Car and recreational vehicle rentals are taxed at 115.

Understanding the Maryland Sales and Use Tax. To qualify for the exemption the vendor must operate a substantial grocery or market business as defined in Section 11-206 a of the Tax-General Article at the same location where the food is sold. Vendors should multiply their gross receipts by 9450 percent before applying the 6 percent rate to determine the tax due on gross receipts derived from vending machine sales.

Exact tax amount may vary for different items. The tax must be separately calculated on sales of alcoholic beverages at the 9 rate and on sales of food non-alcoholic beverages and other merchandise at the 6 rate. The Supplemental Nutrition Assistance Program SNAP formerly known as Food Stamps helps low-income households buy the food they need for good health.

California 1 Utah 125 and Virginia 1. The rate in Maryland is currently set at 6 but not everything falls into the taxable category. Heres what you should know.

In the state of Maryland sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Rates - Maryland taxes various goods and services at different rates. The 9 tax amount must be listed separately from the 6 tax amount on the bill of sale.

A cottage food business or a home-based business is defined in the Code of Maryland Regulations COMAR 10150 3 as a business that a produces or packages cottage food products in a residential kitchen. 02333gallon tax in Garrett County. The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages.

Sale of beer wine and distilled spirits for OFF PREMISES consumption. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. However vehicle rentals and the sale of alcoholic beverages are taxed at different rates.

All sales of food and beverage are subject to the tax except the following cases. The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. You may be wondering what the percentage rate is when it comes to the food sales and use tax and what that tax rate covers.

Groceries and prescription drugs are exempt from the Maryland sales tax. And b has annual revenues from the sale of cottage food products in an amount not exceeding 25000.

The World Is Full Of Conflicting Advice About Food Here S How To Make Sense Of It Food Ads Vintage Recipes Retro Recipes

Exemptions From The Maryland Sales Tax

Nonprofit 501 C 3 Articles Of Incorporation How To Write With Sample Non Profit Writing Articles

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Antique Beer Labels Old Beer Cans Wine And Beer

Pin By Betty Schmidt Guisinger On Low Carb In 2022 Maryland Style Crab Cakes Car Colors Rogue Car

Maryland Crab Dip With Breadsticks Maryland Crab Dip Crab Recipes Crab Dip

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Arlington Va Local News

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Pin By Jo Taylor On Maryland Hon Food Maryland Beef

Maryland Sales Tax Guide And Calculator 2022 Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

Pin By Santainc On Amazing Infographics Infographic Bits And Bobs New Hampshire

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Maryland Tax Credits Southern

Health Insurance Premium Tax Exclusion Faq Maryland State Retirement And Pension System Pensions Health Insurance Insurance Premium

Attorney Joe Gentile Answers Commonly Asked Questions Maryland Homeowners Have Regarding Property Taxes In 2022 Maryland Property Tax Homeowner

Nothing Says Maryland Summer Than A Regrettable Amount Of Fried Food At A Street Festival Fried Oreos Fr Funnel Cake Yummy Food Food